FWD TO CEO: THE MOST VALUABLE BUSINESS TOOL EVER INVENTED

Tom Roach

22/03/2018

A brand can be a company’s most valuable commercial asset, but persuading CEOs to invest in theirs has never been harder. In an open letter to all CMOs, everywhere, Tom Roach, Managing Partner at BBH, shares key data-points to help them in that task.

Dear All CMOs, everywhere

Hope you don’t mind me writing to you all like this but here’s a brief note, some data-points and a slide deck that could help with an issue more and more of us seem to be having these days.

Have you got a CEO or CFO who just doesn’t seem to ‘get’ brand? Are they happy to allocate budget to performance activity but likely to run a mile before giving you what you need for brand-building? Are you confused about why they devote so little attention and resources to your company’s most valuable commercial asset, its brand? Maybe you even get people saying things like ‘we don’t talk about BRAND here’?

Well you’re not alone. Whilst many of us believe that brands have never been more important, successfully making the case for investing in them has never felt harder.

There are of course loads of reasons for this (quarterly reporting and short-termism chief amongst them) but it’s also partly because, to quote Jeremy Bullmore, ‘brands are fiendishly complicated, elusive, slippery, half-real, half-virtual things. When CEOs try to think about brands, their brains hurt’.

Brands are probably the most powerful and versatile business tool ever invented. And yet there’s a growing breed of business leaders who behave as if creating a famous, preferred, distinctive brand is an unnecessary luxury. Who think it’s enough to pay for PPC, sort the SEO, create content, build a digital eco-system, communicate one-to-one with existing customers ‘for free’, or re-target prospects who’ve signalled some level of intent. Of course there are individual businesses that seem to be ok doing things this way, but if there’s a large body of evidence (not simply a few case studies) that proves the above approach can be used to drive long-term profitable growth across a range of categories, without investment in brand-building, I’d love to see it.

If businesses aren’t investing in their brand, maybe it’s our fault? I suspect we haven’t been selling the idea of brands as a business tool correctly. Marketers have tended to dwell on the mental and emotional side of brands (the hard to value stuff in people’s heads like memories, associations, feelings, values and personality). We’ve forgotten to give enough emphasis to the stuff that really matters to CEOs and CFOs: the rational, commercial stuff about what brands do to drive commercial value. We’ve been selling the magic but forgetting the logic.

Millions of words have been written on what brands are. So let’s not go down the ‘what’s a brand?’ wormhole – that’s mostly an internal marketing debate. Let’s just agree for now that a brand is something like what’s in people’s heads about a business, product or service. And then let’s focus on what’s most important for now: what brands do to create value.

So here’s a simple briefing document, free from marketing bullshit, explaining why brands are worth investing in:

A strong brand is a business’s most valuable commercial asset. It increases the chances of customers choosing your product or service over your competitor’s, attracting more customers, at a lower cost per sale, who are happy to pay a little more, and will buy it a little more often. A strong brand will deliver more revenue, profit and growth, more efficiently, year after year, and so generate more shareholder value. It can help attract, motivate and retain your second most important asset: your people. And can work as a barrier to entry for future competitors, creating a legal ‘monopoly’.

Here are the supporting data-points:

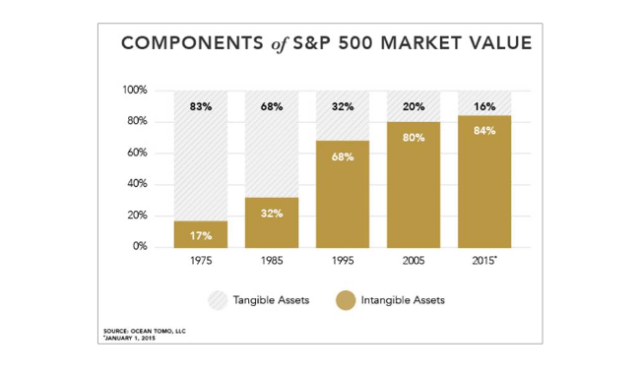

By 2015 around 84% of the value of all businesses was intangible value, of which brand value is a key component, according to Ocean Tomo LLC[1].

2. On average brand value accounts for about 20% of the total market capitalization of businesses according to an analysis of data from all the major brand valuation companies[2].

3. Strong brands far out-perform the average business in terms of shareholder returns, with the BrandZ portfolio of strong brands growing by 124.9% from 2006-2017 vs 34.9% for the MSCI World Index[3].

6. And it found that strong brands are 4x as likely as weak brands to grow in the following 12 months[6].

7. According to Gain Theory, on average a +1% change in brand health (specifically brand consideration) can drive an uplift of 0.5-1.5% total annual sales[7].

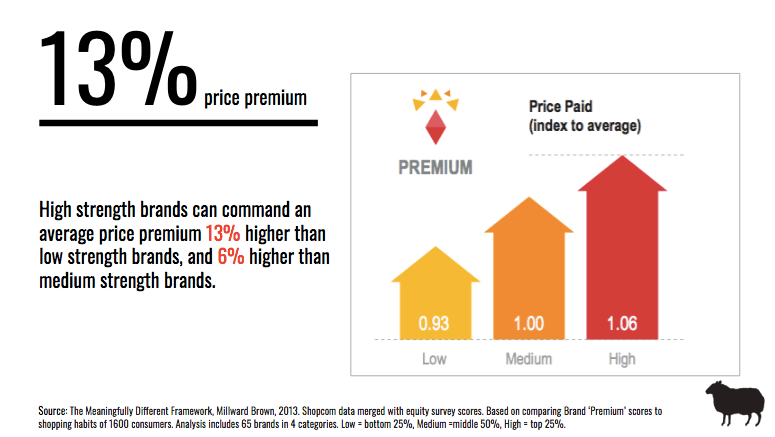

8. And a 10% increase in share of voice can decrease people’s price sensitivity by from 5% to as much as 20%[8] according to the same study. People are willing to pay more for strong, familiar, popular, visible brands.

9. Brand-building activity drives much stronger sales growth over periods of 6+ months than the temporary uplifts driven from by short-term sales activation[9]. Brand-building activity leads to long-term improvements in base sales that short-term sales activity cannot.

10. The optimum split in investment between brand-building and sales activation is on average 60% brand-building, 40% activation[10]. Invest less than 60% in brand activity and the brand equity required to generate future sales will not accumulate.

11. 58% of the sales impact of all marketing communications activity is delivered in the long-term[11]: if you’re only looking at the short-term impact (ie via attribution modelling) you won’t see the full value of your investment.

12. Online businesses in the UK now spend more on brand-building advertising than any other industry sector, £700m on TV alone in 2017[12]. When Google, Amazon and Facebook are amongst the biggest spenders on TV, it’s a pretty big clue that they’re deeply aware of the limits of the digital channels and formats in their own armouries to help them build their own brands.

13. For our last data-point let’s turn to consumers themselves. A CEO’s 1 task is ensuring their company is trusted, according to respondents in the Edelman Trust Barometer[13]. In other words your consumers believe your CEO’s no.1 task is a brand and reputation-building task.

But let’s give the final word to the Sage of Omaha himself, Warren Buffett. A long-term advocate of the power of famous brands to keep the shareholder returns rolling in, he’s been very clear on what he believes is the key measure of a strong business, and it’s closely related to one of the most powerful things a strong brand can help do: give your business pricing power.

Good luck.

Yours faithfully,

Tom Roach